cash app borrow increase

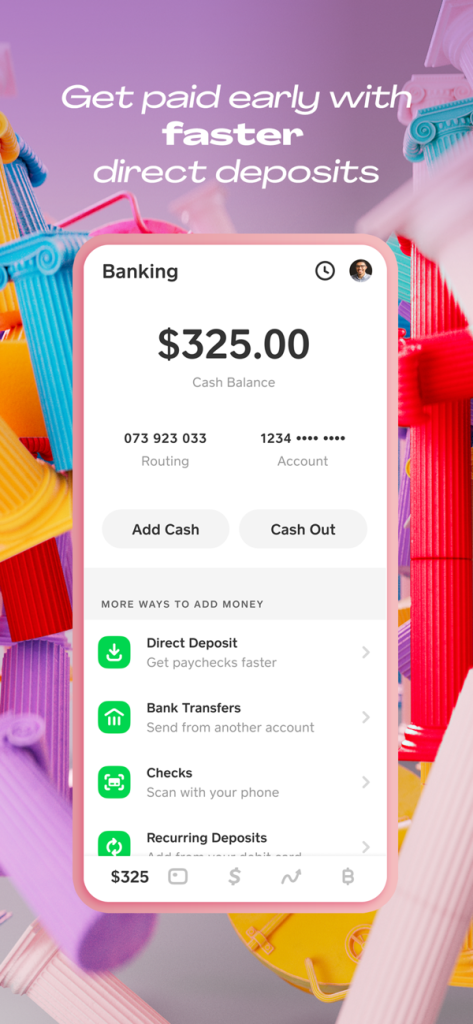

A credit card is a payment card issued to users cardholders to enable the cardholder to pay a merchant for goods and services based on the cardholders accrued debt ie promise to the card issuer to pay them for the amounts plus the other agreed charges. Cash App formerly known as Squarecash is a peer-to-peer money transfer service hosted by Square Inc.

Cash App Borrow Method 2022 How It Works How To Use In 2022 Youtube

Low rate auto loans auto refinancing mortgage loans home equity loans and lines of credit and more.

. Posted by 11 hours ago. Once you pay it back your cash advance limit can increase up to a maximum of 100. Select Continue and follow the easy steps to complete the process.

To access this simply tap the same Buy Load icon on your GCash app dashboard. That Cash App borrow loan of 200 is a great option as an emergency fund. Sign into your Banking App.

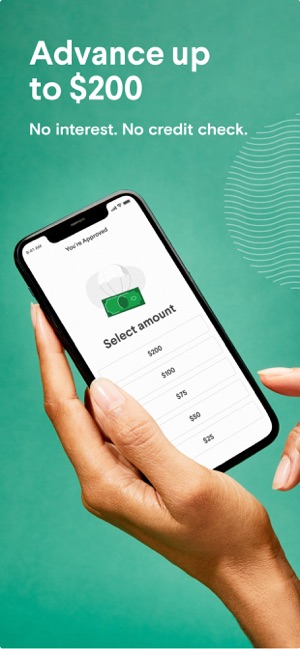

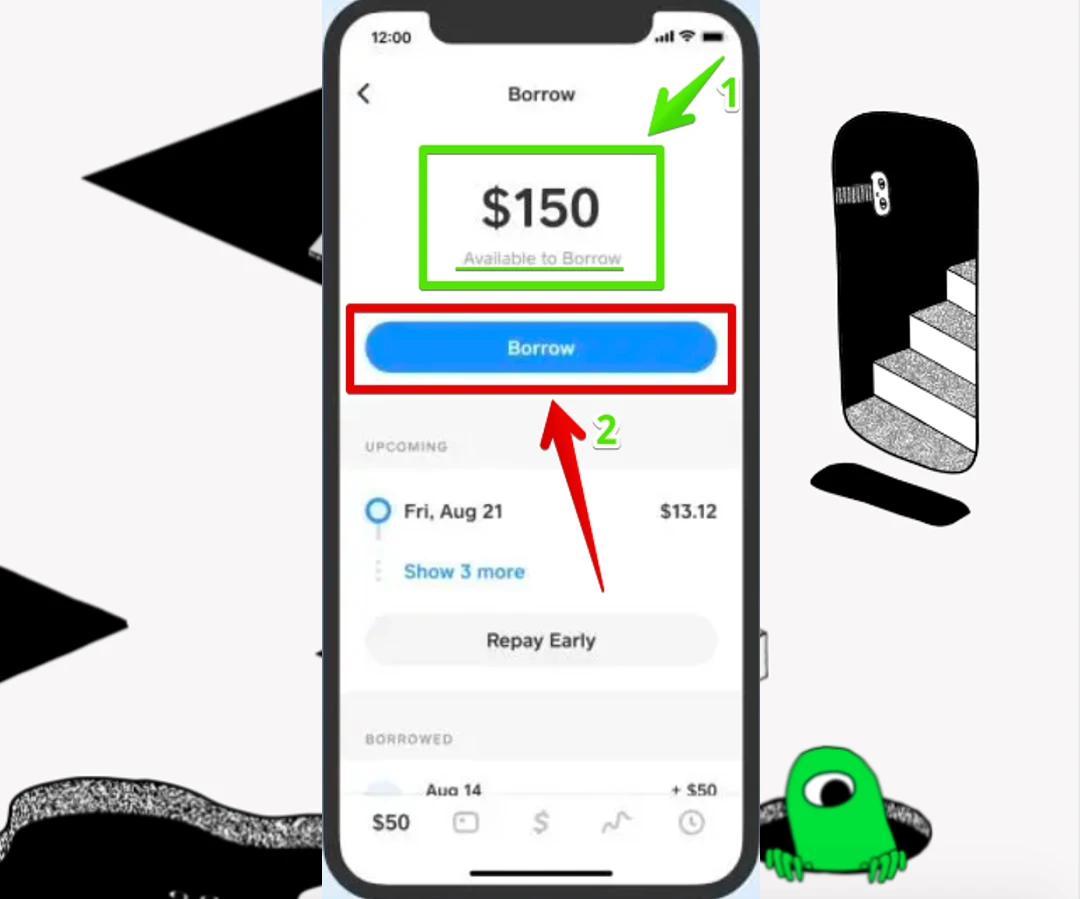

Branches in Chicago Rockford Evanston. Cash App Borrow is a type of short-term loan offered through the platform Cash App. Reduce overdrafts and recoup your hard-earned money.

The Cash App Borrow feature has a flat fee of 5 for your loan unless you are late with your payments in which case that amount does increase. With the MoneyLion app you earn cash back on purchases from select online merchants with your debit. Open the Nexo platform or the Nexo Wallet App.

In addition our free business checking online banking and bill payer allows you to manage your account online or through Lanco FCUs mobile app. There is a reason why they have a 4850 rating with over 20K positive reviews on the App Store you can really make money. Theres no credit check.

Download now to start enjoying flexible access to capital or a new way to make a quick return. Due to anti-money laundering regulations you can only use stablecoins to cover 50 of the collateral required for fiat credit. Top up crypto assets and complete verification.

Access fast and affordable money build credit history and fight bank fees. Get cash now. All you have to do is link your primary checking account to the free MoneyLion app to see the amount of cash you can get right away.

Cash App Scams Read More. This is another popular cash app borrow feature allows consumers to get funded within the next business day and utilize the money for their urgent needs. The gas app also gives you personalized deals on your favorite in-store items so whenever you wanna grab a snack or drink you save big.

They have four weeks to pay it back plus a 5 flat fee. Stellar Lumens XLM 25 APY. Products and services to boost member credit scores increase savings and respond to crises.

You can apply for a minimum loan amount of R3 000 to a maximum loan amount of R300 000. Lend Borrow and enjoy it on your iPhone iPad and iPod touch. Your Instacash amount may increase or decrease over time.

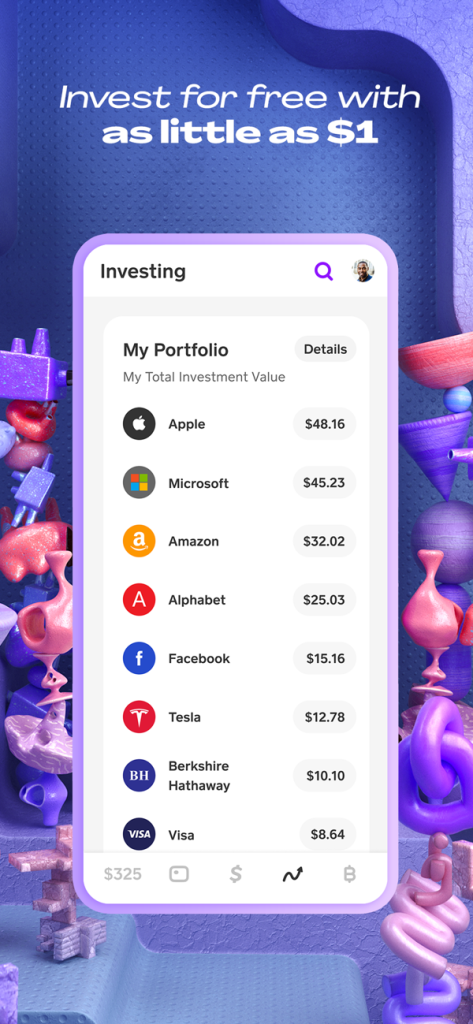

How to Borrow Money on Cash App A New Way to Borrow Is on the Horizon. Fundrise Bonus Link Sign up for Fundrise and start investing in real estate and get 10 in shares. 0 APR with 15 LTV.

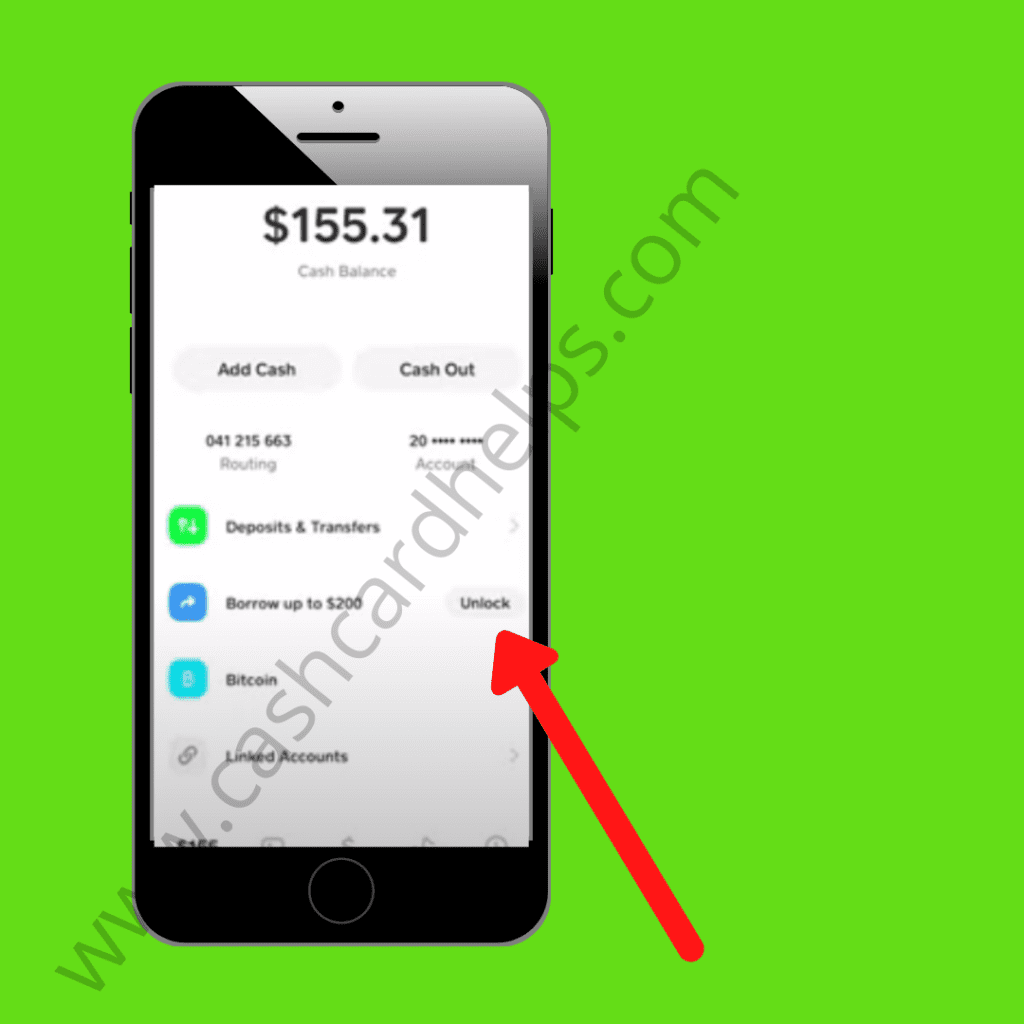

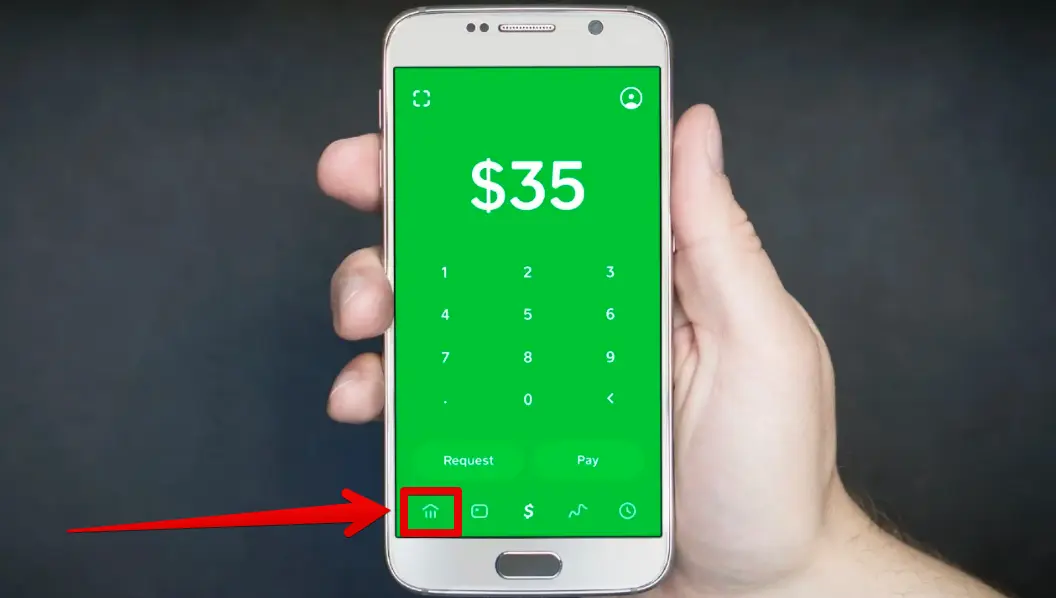

This is still less interest than a typical payday loan and if you pay it back on time it doesnt cost much in interest fees. You start at 20 and your limits increase based on your account activity. Change your limit on the Banking App.

Posting Cashtag Permanent Ban. Iceland and Morrisons have seen prices rise the most. Founded in 2017 Trunow is a free cash back app for gas that will earn you 1 on every gas station receipt you submit.

Second how does your Borrow limit increase. Its a mobile payment system developed by Square Inc which allows users to make financial transfers from one mobile phone to another. A margin account is a brokerage account that gives you the option to use your account as collateral to borrow money.

The difference with. You can also choose from the different load combos with a maximum amount of PHP 20. Two Cash App Scams You Need To Avoid Today Cash App is a popular platform that now has surpassed 25 million monthly active users.

If you want to avoid fees you may choose the core membership as its free of charge. Repay in installments to build your credit history and improve financial health. The other half of the.

If you borrow 100 seven days before you get your next paycheck pay a 599 express fee the monthly 1 subscription fee and add a 1 tip itll cost 799 to borrow the 100. The card issuer usually a bank or credit union creates a revolving account and grants a line of credit to the cardholder. It can also be referred to as a peer-to-peer.

Once you get the load make sure to cash in as soon as possible to pay back the loan. Youre allowed to borrow PHP 10 or PHP 20 worth of regular load. Our service fees are R69 per month for all loans and our once-off initiation fees range from R41975 up to R120750 VAT inclusive.

Its Instacash feature lets you borrow up to 250 with no interest or credit check. Select Open a new account Tap on Personal Lending. Trusted by hundreds of thousands of users SoLo lets you borrow money on your own terms or lend and reap the benefits in the form of a return or social impact.

Borrow against your crypto with interest rates starting at 0 APR. Serving northern Illinois since 1944. Use your extra income for gas station purchases or get instant cash.

97 of our experts correctly predicted the RBA would increase the cash rate at its meeting on 06 September 2022. Borrow up to 500¹ in minutes even with bad or no credit. Crypto Perx CPRX 3 APY.

If you head to your local payday loan provider and borrow 250 at 500 APR and a 50 fee you will have to pay back 348. RCashApp is for discussion regarding Cash App on iOS and Android devices. The big difference between personal and business checking accounts is that business checking accounts are for all types of companies including sole proprietorships limited liability companies LLC.

Think of it as an investment account with a line of credit attached to it. Learn how Abra protects your funds with best-in-class risk management. Eligible borrowers can take out a loan from 20 to 200.

20 Sites to Help You Save Right Now. Cost of living latest as wholesale gas prices soar following Gazproms decision to indefinitely suspend the Nord Stream I pipeline to Europe. This 5 fee for Cash App Borrow translates to a 60 APR overall.

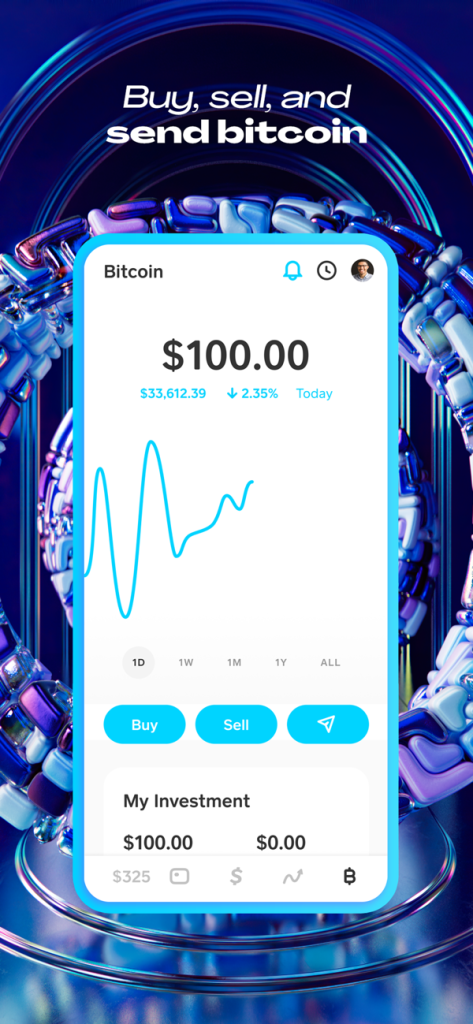

The plus membership will cost you 28 per month. How Cash App Borrow works. Bitcoin Cash BCH 2 APY.

Tap the Borrow button in your Nexo Wallet to withdraw cash or stablecoins instantly. There are two types of membership core and plus. This feature requires no credit check and no proof of regular income.

5 monthly fee x 12 months 60 APR. Deposit checks from anywhere make quick transfers check your balance and more with the Affinity Plus mobile banking app rated. Tap on the More tile at the bottom of your screen.

Fundrise is the first real estate investing app to create a simple low-cost way for anyone to invest in real estate for solid returns. If your limit increase has been approved you will receive an estimated quote. The Reserve Bank raised the official cash rate by 50 basis points to 235.

A revolving line of credit for cash when you need it.

Why Can T I Borrow Money From Cash App Do This First

Why Can T I Borrow Money From Cash App Do This First

Borrow Money App Best Money Borrowing Apps In 2022

How To Borrow Money From Cash App Get Borrow Feature Unlock Now

How To Borrow Money From Cash App Get Borrow Feature Unlock Now

Square S Cash App Tests New Feature Allowing Users To Borrow Up To 200 Techcrunch

Cash App Borrow Method 2022 How It Works How To Use In 2022 Youtube

Cash App Borrow Cash App S Newest Loan Feature Gobankingrates

How To Borrow Money From Cash App In 2022

Borrow Cash Using Bitcoin On Coinbase By Coinbase The Coinbase Blog

How To Borrow Money From Cash App In 2022

Cash App Borrow Cash App S Newest Loan Feature Gobankingrates

Cash App Borrow Method 2022 How It Works How To Use In 2022 Youtube

Why Can T I Borrow Money From Cash App Do This First

How To Borrow Money From Cash App In 2022

Why Can T I Borrow Money From Cash App Do This First

How To Borrow Money From Cash App Get Borrow Feature Unlock Now